In 2025, Stripe remains one of the top payment processors for businesses worldwide, offering a secure way to accept online payments. However, to ensure smooth transactions and protect against fraud, businesses need to use verified Stripe accounts. These accounts are more reliable and help avoid delays or rejections in payment processing.

For e-commerce businesses, verified Stripe accounts are essential. They reduce fraud risks, lower chargeback rates, and improve trust with customers. As online payment challenges increase, verified accounts ensure a safer, faster payment experience.

While Stripe is a popular choice, other payment processors, like PayPal and Square, also serve similar purposes. In this guide, we’ll look at the benefits of buying verified Stripe accounts and how they compare with other payment solutions.

Key Features of Verified Stripe Accounts in 2025

Verified Stripe accounts come with several features that set them apart from unverified accounts. These accounts are designed to offer businesses better security, faster payment processing, and a smoother user experience.

- Stripe Account Verification Process: The process to verify a Stripe account involves providing business details, identity verification, and sometimes linking a bank account. This ensures that only legitimate businesses can use Stripe for payment processing.

- Account Security in 2025: With the growing number of online frauds, verified Stripe accounts provide enhanced security. They are less likely to face issues like account suspension or fraud flags. Stripe also adds features like two-factor authentication (2FA) to protect account access.

- Advantages of Verified Stripe Accounts: Verified accounts offer a higher level of trust. They allow faster payment processing, lower fraud risks, and increased transaction limits, making them ideal for businesses handling large amounts of transactions.

- Differences Between Verified and Unverified Stripe Accounts: The key difference is reliability. Unverified accounts may face restrictions, delays in payments, or even suspension. Verified accounts, on the other hand, are trusted by Stripe and its partners, making them more reliable for seamless business operations.

- Digital Payment Solutions in 2025: In the current digital age, businesses require trusted payment processing solutions to thrive. Verified Stripe accounts ensure safe transactions, making them an excellent option for online businesses that rely on smooth, secure payments.

- Online Business Payment Tools: Verified accounts give businesses access to powerful payment tools, including recurring payments, fraud prevention, and multi-currency support, helping companies scale and manage transactions worldwide.

In conclusion, buying verified Stripe accounts gives businesses access to a secure, trusted payment solution with a smooth setup process, making them an essential tool for success in 2025.

Pros and Cons of Buying Verified Stripe Accounts

When considering whether to buy verified Stripe accounts, it’s important to weigh the advantages and disadvantages. Here's a breakdown to help you decide if it's the right choice for your business.

Pros:

- Improved Payment Processing: Verified Stripe accounts offer faster, more reliable transactions, ensuring your customers can complete payments without issues.

- Higher Transaction Success Rate: Verified accounts typically have a higher success rate for processing payments, reducing the chances of declines.

- Faster Business Startup: With a verified account, businesses can start accepting payments almost immediately, avoiding the delays associated with the verification process.

- Reduced Risk of Account Suspension: Verified accounts are less likely to be flagged or suspended by Stripe, allowing businesses to maintain consistent operations.

- Stripe Account Reliability: As a trusted payment processor, Stripe ensures smooth and efficient payment processing for businesses worldwide.

- Fraud Protection: Verified accounts come with advanced security features that help prevent fraud, ensuring safer transactions for both businesses and customers.

- Secure Online Payments: Verified accounts provide secure payment methods for customers, improving their trust and overall experience.

- Streamlined Payment System: Access to Stripe's advanced features, like recurring payments and multi-currency support, helps businesses grow and manage transactions efficiently.

Cons:

- Legal and Ethical Concerns: Purchasing verified accounts could violate Stripe's terms of service, potentially leading to account suspension or legal issues.

- Potential Financial Risks: If the account has a problematic past, such as chargebacks or fraud flags, it could create challenges for the business in the future.

- Pricing Challenges: Verified accounts can be expensive, especially for small businesses or startups that may be operating with a tight budget.

- Risks of Fraudulent Suppliers: Some suppliers may not be trustworthy, which could lead to purchasing an account that isn't properly verified or could be flagged later.

- Account Purchase Risks: There’s always a chance that the purchased account could be revoked or flagged by Stripe, leading to operational disruptions.

- Stripe Account Limitations: Some verified accounts may still have transaction limits or restrictions, depending on the provider or account history.

- Hidden Fees: There may be additional charges for account maintenance or verification, which could add to the overall cost of buying a verified account.

Verified Stripe Accounts vs. Alternative Payment Solutions

Here's a comparison table highlighting the key differences between Verified Stripe accounts and alternative payment solutions like PayPal, Square, and Authorize.Net:

| Feature | Verified Stripe Accounts | PayPal | Square | Authorize.Net |

| Flexibility for Cross-Border Payments | Supports payments in multiple currencies, reducing delays and additional charges. | Higher fees for international transactions and longer fund holding times. | Focuses more on local transactions; international payments are more limited. | Suitable for international transactions but may charge higher fees. |

| Transaction Fees | Lower and transparent fees, especially for high-volume transactions. | Higher fees, especially for large transactions or international payments. | Competitive fees, but generally higher than Stripe's for some transactions. | Fees can vary depending on transaction volume, generally higher than Stripe. |

| Customization & Integration | Excellent for custom payment systems; developers can integrate Stripe easily into websites/apps. | Limited customization; more rigid integration options for developers. | Basic integration tools, mainly for point-of-sale systems. | Good for customized integration, but not as developer-friendly as Stripe. |

| Alternative Payment Methods | Supports credit cards, digital wallets, ACH transfers, and more, making it versatile. | Primarily supports credit cards and PayPal accounts. | Focuses on card payments, with limited options for other methods. | Offers credit cards and e-checks, but lacks support for digital wallets and other methods. |

| Advantages in 2025 | Ideal for modern e-commerce with cross-border payments, low fees, and extensive integrations. | Still widely used but limited by higher fees and fewer customization options. | Great for local businesses, but less suitable for global-scale e-commerce. | Works well for small to mid-sized businesses but lacks some of Stripe’s flexibility and features. |

This table helps compare Verified Stripe accounts with PayPal, Square, and Authorize.Net, highlighting Stripe's strengths in cross-border payments, lower fees, and flexibility for e-commerce businesses in 2025.

In conclusion, Verified Stripe accounts provide businesses with clear advantages over other payment solutions. Stripe’s transparent pricing, flexible payment processing, and powerful integration options make it the ideal choice for businesses seeking a reliable and cost-effective payment solution.

Market Price and Supplier Comparison for Verified Stripe Accounts

When considering to buy Verified Stripe accounts, it’s important to understand the market prices and compare different suppliers to ensure you get the best deal. Verified Stripe account pricing in 2025 can vary depending on several factors, including the account’s history, features, and the supplier you choose.

- Pricing Factors for Verified Stripe Accounts

The cost of a Verified Stripe account is influenced by multiple factors. A key factor is the account history. Accounts with a clean transaction history and no past issues are typically priced higher. Suppliers offering accounts with established credibility and a strong track record will charge more, as these accounts are deemed more reliable. Additionally, the Stripe account packages offered by different suppliers can also affect pricing. Accounts with more advanced features, such as additional security settings or the ability to process larger volumes of transactions, tend to cost more. - Supplier Comparison

When looking to buy Verified Stripe accounts, it’s crucial to compare different suppliers. Some suppliers offer accounts at lower prices but may not provide the same level of customer support or the same guarantees regarding account safety. Others might charge higher prices, but the accounts come with better customer service, a smoother setup process, and faster verification. For instance, some suppliers offer Verified Stripe accounts that come pre-approved for international transactions, while others might only offer basic, domestic accounts. - Market Prices for Verified Stripe AccountsMarket prices for verified Stripe accounts in 2025 are generally consistent, but some suppliers may offer discounts or special deals depending on the demand or the features included with the account. On average, prices range from $100 to $300 per verified account, but accounts with premium features or high transaction limits can cost more. It's always recommended to carefully evaluate what is included in the package and whether the price aligns with the value you’re getting.

- Buying Verified Stripe Accounts Legally

It’s essential to ensure you’re buying Verified Stripe accounts legally. Always choose reputable suppliers who follow Stripe’s terms of service and ensure that the accounts are not involved in fraudulent activities. Buying accounts from unauthorized or suspicious sources can lead to account suspension or other legal issues. Make sure to read reviews, ask for references, and verify that the supplier follows proper procedures when selling Verified Stripe accounts.

Evaluating the Value of Buying Verified Stripe Accounts

When deciding whether to buy Verified Stripe accounts, it’s important to weigh the benefits and potential drawbacks. For businesses looking to streamline their payment processes, purchasing a Verified Stripe account can provide valuable advantages. However, it's also crucial to evaluate if it aligns with your specific business needs.

- Is Buying Verified Stripe Accounts Worth It?

For many businesses, especially those just starting or expanding into new markets, buying a Verified Stripe account can save time and effort. It allows you to quickly set up a payment system without waiting for verification or approval from Stripe. For instance, a new online store looking to start accepting payments can avoid the delays that often come with setting up a fresh account. This makes it a practical choice if you want to focus on running your business rather than dealing with account setup hurdles. - Practical Benefits of Verified Stripe Accounts

One of the main benefits of buying a Verified Stripe account is immediate access to Stripe’s payment processing system, which is trusted by businesses worldwide. This can help improve customer trust and streamline transactions, as Stripe offers secure, reliable services. Additionally, Stripe supports a wide range of payment methods, including credit cards, Apple Pay, and Google Pay, which can be beneficial for businesses with diverse customer bases. - Who Should Consider Buying Verified Stripe Accounts?

If your business operates online and needs to quickly process payments, buying a Verified Stripe account might be the right choice. This is especially true for entrepreneurs, freelancers, or small businesses that are launching or scaling their online operations. For example, a freelance web designer might need to accept payments for services quickly, and having a Verified Stripe account can make this process easier. On the other hand, large businesses with established payment systems may not need to buy a verified account but can still benefit from Stripe’s services through other means. - Evaluating Stripe Accounts for Business Use

Before purchasing a Verified Stripe account, it’s important to assess how well it fits your business’s specific needs. Does it support the countries and currencies your business operates in? Can it handle the volume of transactions you expect? For example, a business with international customers might benefit from Stripe’s cross-border payment capabilities. Additionally, make sure the account you purchase is compatible with your website or platform for smooth integration.

Top Platforms and Vendors to Buy Verified Stripe Accounts

If you're considering purchasing a Verified Stripe account, it's essential to choose reputable platforms and vendors to ensure security and compliance. Here are some trusted sources where you can acquire verified Stripe accounts:

PvaSellUSA specializes in providing verified Stripe accounts with proper business registration details, such as EIN and a registered business name. They are known for delivering accounts quickly, allowing businesses to start accepting payments without unnecessary delays.

Pros:

- Comprehensive Verification: Provides fully verified Stripe accounts with business details, ensuring smooth payment processing.

- Fast Delivery: Accounts are delivered quickly, helping businesses get up and running fast.

- Responsive Support: Offers 24/7 customer support via various channels like email, WhatsApp, and Telegram.

Cons:

- Limited Public Reviews: While PvaSellUSA claims positive feedback, there’s a lack of independent, third-party reviews, which makes it hard to verify their overall customer satisfaction.

FastDelivery.shop is a well-regarded platform that focuses on providing legally compliant Stripe accounts with business registration in the US and UK. They offer a full-service package, which includes setting up a company and integrating Stripe for online payment processing.

Pros:

- Legal Compliance: Provides fully registered business accounts, ensuring compliance with Stripe’s terms and conditions.

- All-in-One Service: Streamlines the entire process, from business registration to payment gateway setup, saving businesses time and effort.

Cons:

- Higher Pricing: The all-inclusive services come at a premium, making it more expensive compared to other vendors. This might not be suitable for businesses with smaller budgets.

Smmmarketusa offers a variety of Verified Stripe accounts, including those with transaction history, making them ideal for businesses looking for accounts with a proven track record. They provide customer support around the clock, helping clients set up and manage their accounts.

Pros:

- Variety of Options: Offers a wide range of Stripe accounts, from fresh accounts to those with established transaction histories.

- 24/7 Support: Dedicated customer service ensures assistance is available at any time for troubleshooting and guidance.

Cons:

- Mixed Reviews: Customer feedback varies. While some customers praise the service, others have raised concerns about the consistency and quality of accounts.

Vrtsmm specializes in offering secure and verified Stripe accounts tailored for freelancers and small businesses. Their platform focuses on providing high-quality accounts, ensuring safe and efficient transactions for users who want to integrate Stripe for their online operations.

Pros:

- Secure Transactions: Emphasizes providing safe, verified Stripe accounts to prevent issues such as chargebacks or account suspensions.

- Prompt Delivery: Known for delivering accounts quickly, allowing businesses to start using Stripe without delay.

Cons:

- Limited Product Range: Primarily focuses on Stripe accounts, meaning that users seeking other payment processing services may find fewer options.

SellAuth is an e-commerce platform that offers fully integrated payment solutions, including Stripe accounts. They allow businesses to set up online storefronts with integrated Stripe payment systems, providing users with a complete solution for running e-commerce operations.

Pros:

- Integrated Payment Solutions: Provides hosted storefronts with integrated payment processing through Stripe, making it easier for businesses to accept payments.

- Customizable Themes: Offers free themes for storefronts, which can be customized according to the business’s branding needs.

Cons:

- Customer Support Concerns: Some users have reported issues with customer service, particularly in the absence of a ticketing system and additional charges for domain changes.

Tips for Buying Verified Stripe Accounts Safely

- Research the Vendor: Before purchasing, check reviews and ratings to ensure the vendor's credibility.

- Verify Documentation: Ensure the account comes with proper verification documents to avoid potential issues with Stripe.

- Understand Terms and Conditions: Review the terms of service to ensure compliance with Stripe's policies and avoid account suspension.

- Secure Payment Methods: Use secure payment methods to protect your financial information during the transaction.

- Customer Support: Choose vendors that offer responsive customer support to assist you in case of any issues post-purchase.

By selecting reputable platforms and following these safety tips, you can ensure a smooth and secure process when acquiring a Verified Stripe account.

Why Use DICloak for E-Commerce?

If you're running an online business and managing multiple accounts on e-commerce platforms like Amazon, eBay, or Shopify, DICloak can be an invaluable tool.

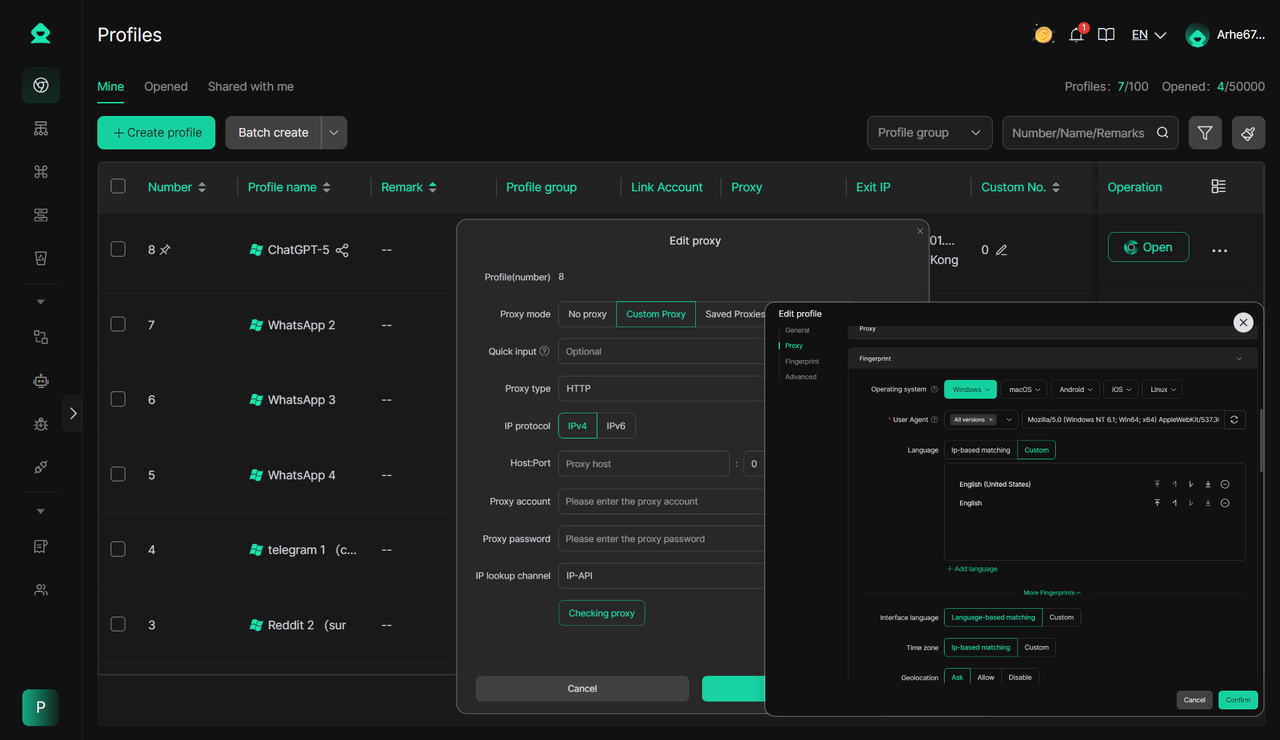

1. Effortless Multi-Account Management

- Manage multiple e-commerce accounts on platforms like Amazon, eBay, and Shopify from one device.

- Each account runs in its own isolated profile with a unique digital fingerprint, reducing the risk of bans and conflicts.

- Easily switch between accounts without detection.

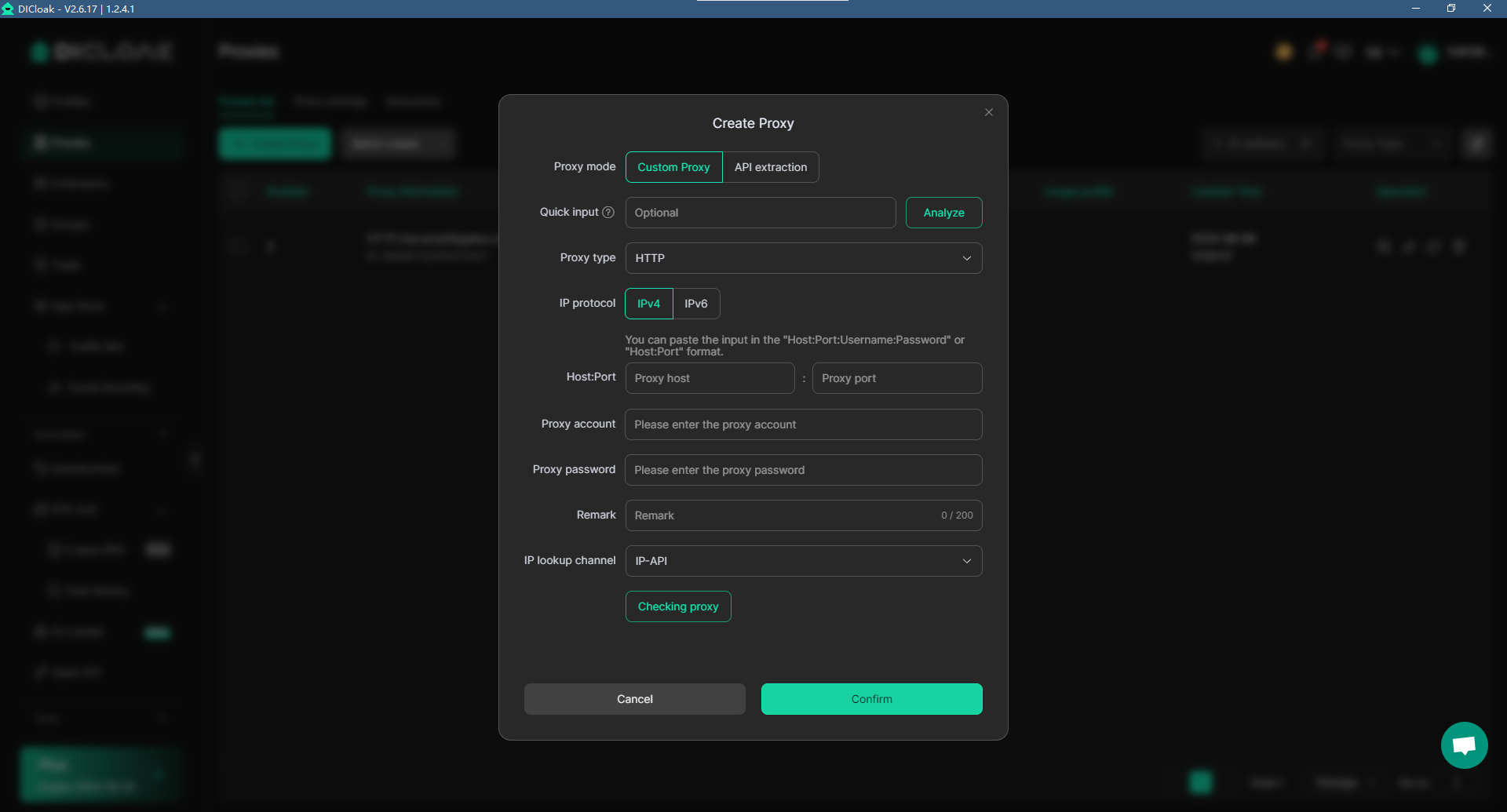

2. Reduced Risk of Account Detection

- Unique IPs for Each Profile: With DICloak's proxy configuration, you can assign a unique IP address to each browser profile, making each account appear as separate from others.

- Geo-location Control: You can also control the geographical location of the IP address by using proxies from different countries. This feature is especially useful if you’re managing accounts across various regions or need to bypass geo-restrictions.

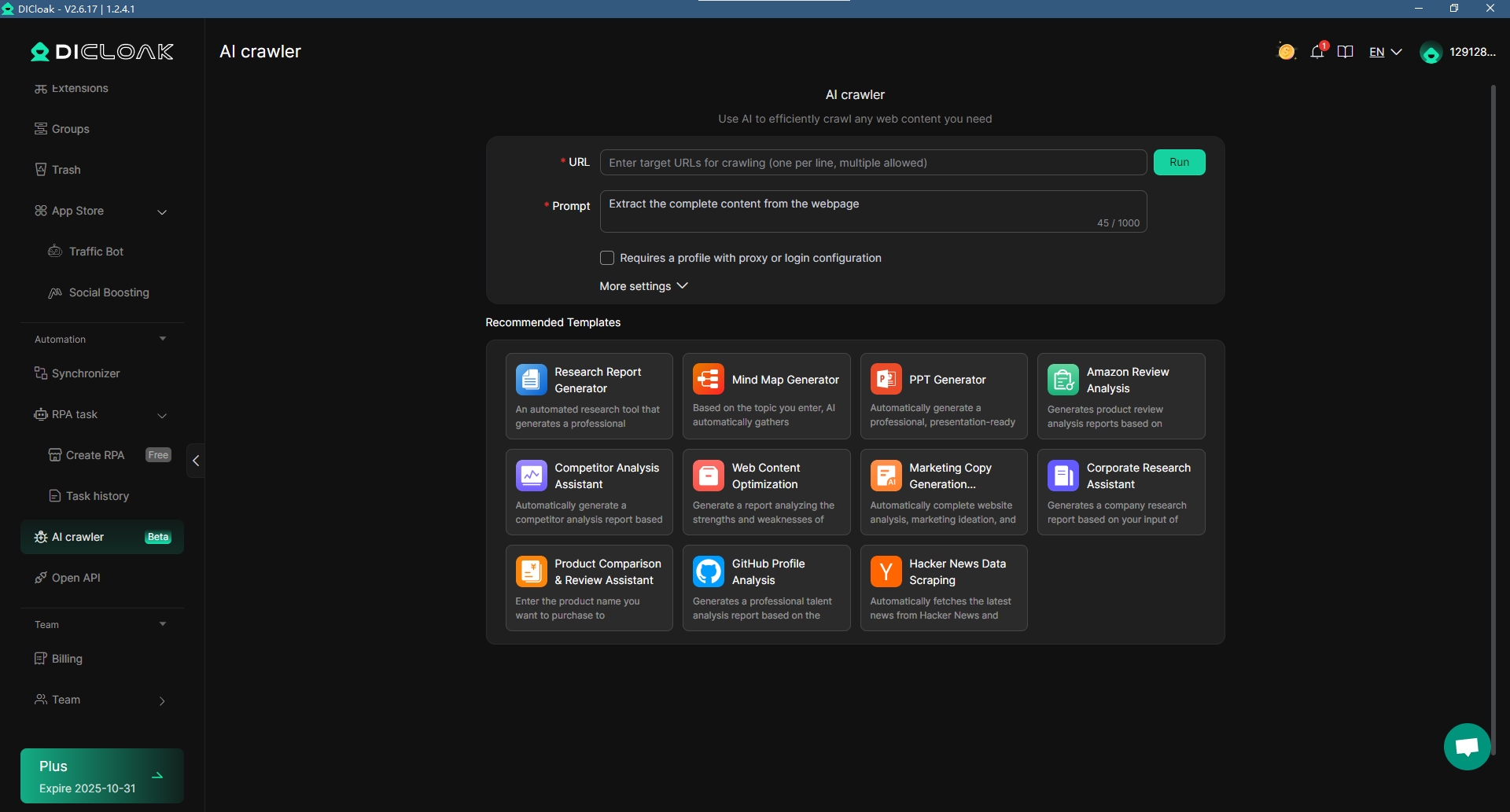

3. AI-Powered Market Research

- Use the AI Crawler to collect competitor data, compare market prices, and scrape competitor reviews.

- Save time on manual research and optimize your marketing strategies with real-time insights.

DICloak makes managing multiple e-commerce accounts and ad campaigns simpler, safer, and more efficient, helping businesses stay competitive and organized.

Conclusion

In 2025, buying verified Stripe accounts can be a smart choice for businesses needing fast, secure payment processing, especially for international transactions. Stripe offers benefits like multi-currency support, lower fraud risks, and reliable payment processing. However, PayPal, Square, and other alternatives might be better for businesses with specific needs, like lower fees or simpler integration. Always buy verified Stripe accounts from trusted vendors and ensure compliance with Stripe's terms of service. Overall, Stripe remains a top choice for global businesses, but it's important to compare options based on your unique requirements.

FAQ

- What are Verified Stripe Accounts?

Verified Stripe accounts are accounts that have undergone Stripe’s verification process, ensuring secure and reliable payment processing. These accounts provide businesses with higher transaction limits, enhanced security, and access to advanced Stripe features. - Why should I buy Verified Stripe Accounts in 2025?

Buying verified Stripe accounts allows businesses to start processing payments immediately, reduce fraud risks, and ensure faster, smoother transactions, especially for international operations. - What is the difference between Verified and Unverified Stripe Accounts?

Verified Stripe accounts have gone through a strict verification process, making them more reliable, secure, and trusted by Stripe. Unverified accounts may face limitations, delays, or even suspension. - Are there any risks in buying Verified Stripe Accounts?

Yes, purchasing from unreliable suppliers could lead to fraud, account suspension, or legal issues. It’s essential to buy from trusted vendors and ensure the accounts are fully verified.