PayPalis the world's leading online payment platform, committed to providing convenient and secure online payment and transfer services. Since its inception in 1998, PayPal has grown to become the go-to tool for cross-border payments, supporting multiple currencies and serving in more than 200 countries and territories.

For cross-border e-commerce sellers,PayPalNot only does it simplify international transactions, but it also provides payment security for both buyers and sellers. Whether you're accepting payments from international customers or withdrawing earnings to local accounts, PayPal is an important tool for efficiency and security.

At the same time, in response to the needs of cross-border payment, this article will further explore PayPal's registration process, exchange rate settings and solutions for associated risks, to help cross-border e-commerce sellers use PayPal efficiently in business operations, especially through itDICloak Fingerprint BrowserAchieve multi-account management and operational optimization.

What is PayPal?

PayPalPayPal, Chinese name "PayPal", is one of the world's leading online payment platforms, focusing on providing convenient and secure online payment and transfer services. Since its inception in 1998, PayPal has become the go-to tool for cross-border payments, supporting multiple currencies and offering its services in more than 200 countries and territories.

For cross-border e-commerce sellers, PayPal is an important tool to simplify the international transaction process, while also providing payment security for buyers and sellers. Whether you're accepting payments from international customers or withdrawing earnings to local accounts, PayPal helps sellers complete transactions efficiently.

The difference between PayPal China account and US account

Choosing the right PayPal account type is an important step in optimizing your cross-border EC operations."PayPal China Account"and"PayPal US Account"There are significant differences in functions, transaction amounts, and applicable scenarios.

China Account Features:

- Suitable for local users: Support binding of Chinese bank cards and local withdrawals.

- Functional limitations: There are fewer international trading options and relatively low transaction amounts.

- Currency processing: RMB is mainly used as the base currency, but some foreign currencies are exchanged and paid.

U.S. Account Features:

- More payment options: Support a wider variety of international currency transactions to facilitate the processing of complex cross-border orders.

- Higher transaction limits: suitable for large payments and high-frequency international transactions.

- International shopping advantages: Many international marketplaces, such as Amazon, prefer to accept PayPal accounts in the United States to avoid cancellations due to account restrictions.

- Which account is right for you?

- If you're primarily targeting the domestic market and occasionally handle small cross-border transactions, a PayPal China account is the answer.

- If you are engaged in cross-border e-commerce business, need to make frequent international payments and withdrawals, or often use international shopping platforms, it is recommended to open a PayPal US account.

- PayPal US accounts are ideal for cross-border transactions due to their flexibility, strong international payment capabilities, and lower processing fees. By understanding the characteristics of both accounts, sellers can choose the most suitable account type according to their business needs, allowing them to manage the international payment process more efficiently.

What you need to sign up for PayPal USA

- Stable network environment:Make sure you use a fixed and secure network connection. Frequently switching IP addresses or using an unsecured network can trigger PayPal's security mechanisms, resulting in account restrictions.

- Valid U.S. Address:You'll need a valid U.S. mailing address for account verification. You can use the address provided by the forwarding company, or ask a friend or family member in the U.S. to help provide the address.

- U.S. Mobile Phone Number:A U.S. mobile phone number that can receive text messages is required. PayPal sends security codes and notifications via SMS.

- International Email Address:It is recommended to use international mailboxes such as Gmail, Outlook, Yahoo, etc., which are stable and widely accepted to ensure that you receive important emails from PayPal smoothly.

- Real Name:When registering, you need to fill in your real name that is the same as the bank card you have bound. If the names don't match, it can lead to failed verification or even account freezing.

- Credit or debit card:Have a credit or debit card from Visa, MasterCard, or American Express. The card needs to support international payments and not be linked to another PayPal account.

PayPal sign-up process

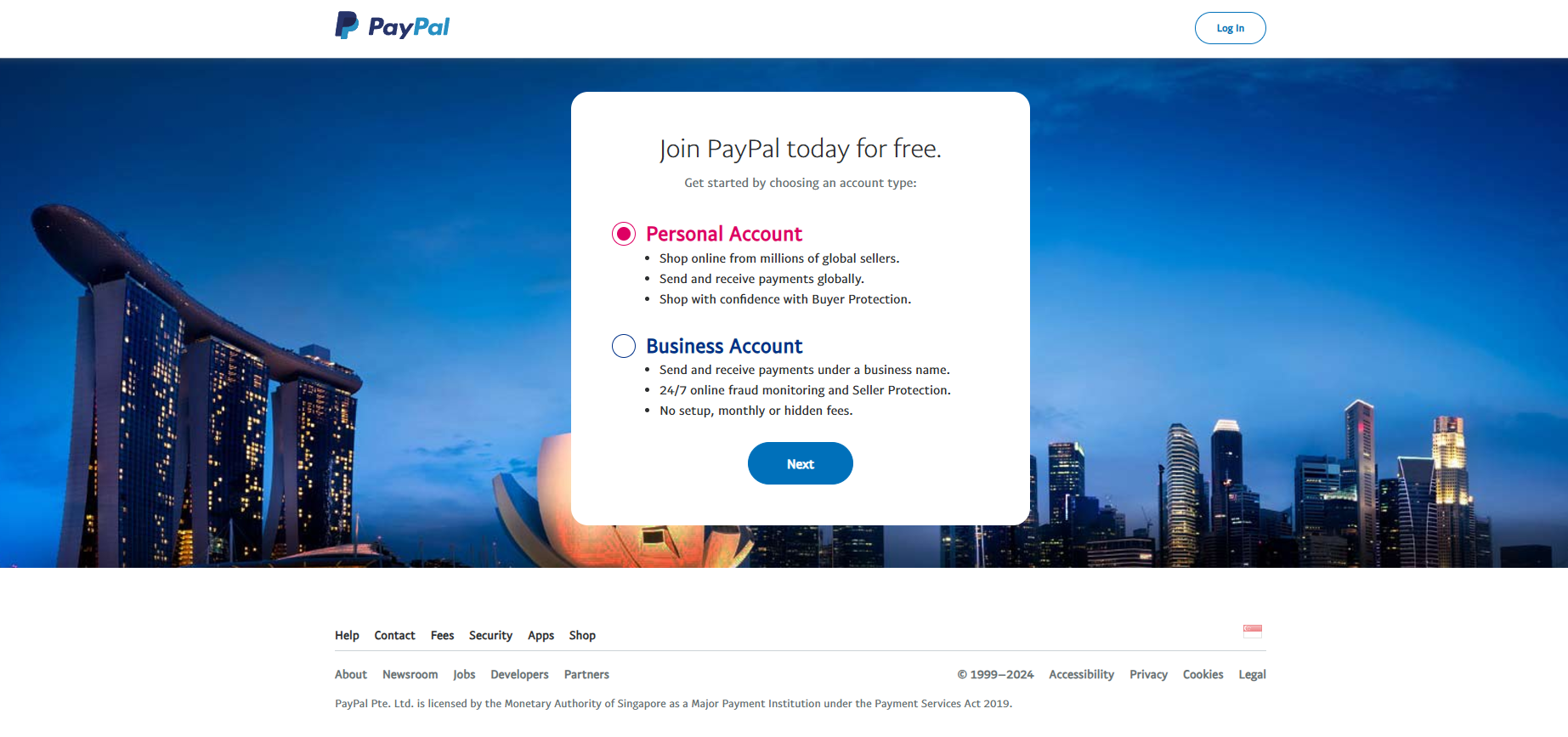

- Visit the official website:enterPayPal US official website, click the register button to enter the registration page.

- Select Account Type:The default option is Personal Account, which is suitable for most users. If you are a cross-border e-commerce seller who needs to trade in bulk, you can choose a Business Account.

- Enter your email address:It is recommended to use Gmail or a similar international email address and click "Next".

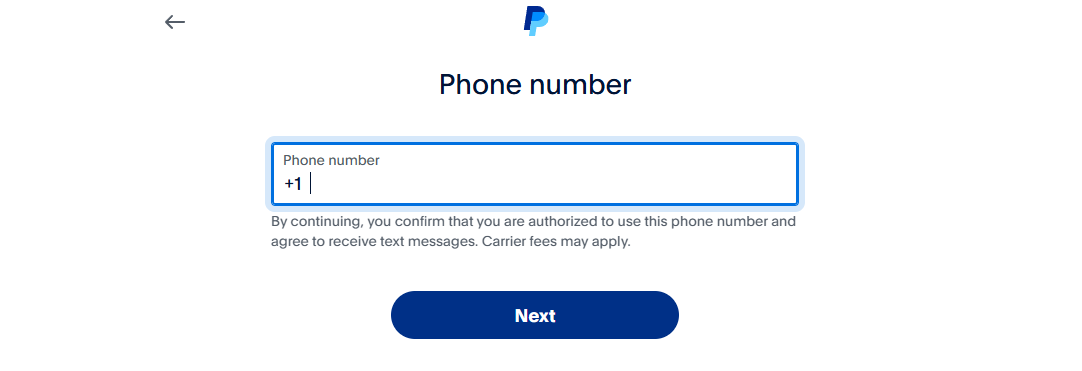

- Fill in the U.S. mobile phone number:Enter a valid mobile phone number and fill in the verification code you received to complete the verification.

- Fill in your personal information:Enter your real name, set a password, and make sure all the information is accurate.

- Complete captcha validation: Make sure you're a legally registered user with simple captcha.

- Fill in the billing address:Enter your U.S. address, choose a private address or a forwarding company address. Click "Agree and Create Account" to create an account.

- Link a credit or debit card:Go to the Bind Card page and fill in the card information. Make sure that the linked card is not linked to another PayPal account. Click on "Link Card" when you're done.

- Confirm your email address: Log in to your registered email address, find the PayPal verification email, and click the link in the email to complete the email verification.

- Verify your mobile number:Log in to your PayPal account and follow the prompts to complete mobile number verification. This is the final step of registration

After successful registration, how to optimize the use of PayPal?

Through the above steps, yourPayPalThe account has been successfully registered. Once registered, you can:

- Set exchange rate options to reduce currency conversion costs and avoid exchange rate losses.

- Bind more payment tools to provide a variety of options for cross-border e-commerce transactions.

- Update your account information regularly to ensure security.

How to save cross-border transaction costs by optimizing PayPal exchange rates

As a cross-border e-commerce seller,How PayPal sets the exchange rateis a problem that cannot be ignored. Currency exchange rates in international transactions directly affect your earnings, and many sellers inadvertently fall into PayPal's "exchange rate trap", resulting in unnecessary losses. This article will take you to understandPayPal exchange rateand share practical tips to optimize your settings to help you effectively manage your cash flow and protect your profits from exchange rate differentials.

Why is the PayPal exchange rate high?

PayPal exchange rate refers to the internal exchange rate used by PayPal during the currency conversion process. Unlike the real-time exchange rate in the forex market, PayPal includes additional conversion fees in the exchange rate, which is one of its main sources of income. Especially in China, many PayPal international accounts transact and withdraw in USD by default, but when it comes to non-USD currencies, currency conversion fees inevitably increase costs for sellers.

Factors affecting PayPal exchange rates

1. Currency Conversion Fee

PayPal's currency conversion fee is a major source of additional fees. When making foreign currency transactions, PayPal adds a percentage of the market exchange rate to the market rate, which makes its exchange rate higher than the regular exchange rate.

2. The impact of credit card types

Different credit card types affect the final exchange rate cost. For example:

- Visa cards typically use an exchange rate close to the average exchange rate in the market, so there are fewer additional fees when it comes to currency conversion.

- MasterCard and American Express (AE) may use PayPal's internal high exchange rate, resulting in additional fees.

- 3. PayPal's internal procedures

PayPal has its own currency conversion program, which makes its exchange rate slightly higher than the one offered by credit card issuers. This difference is especially significant in large-value payments, and for cross-border e-commerce sellers, this "hidden cost" may have a greater impact on profits.

How to set exchange rates with PayPal to save on cross-border transaction costs

The exchange rate of cross-border transactions is a key link that sellers cannot ignore. Here's what about:How PayPal sets the exchange rateDetailed steps:

1.Manually change the currency conversion settings

Once you've logged in to PayPal, go to the Settings page, select the credit card in Payment methods and change your preference to "Use the issuer's exchange rate." This is an effective way to avoid high currency conversion fees.

2.Choose the right credit card type

If you primarily use PayPal for large payments, it is advisable to prefer a Visa card, as it typically offers an exchange rate closer to the market exchange rate, reducing additional costs.

3.Pay attention to the choice of withdrawal currency

For sellers in China, PayPal transacts in USD by default, but if you frequently use other currencies, you can avoid multiple conversion fees by selecting local currency withdrawals.

How to prevent PayPal account linking: Multi-account management tools for cross-border sellers DICloak Fingerprint Viewer

When using PayPal to collect payments, cross-border sellers not only need to pay attention to exchange rate settings, but also need to solve the challenges of multi-account management. Especially when managing multiple PayPal accounts and cross-border e-commerce platform accounts, challenges include:

- Account Linkage Risk:The use of the same device or similar browser fingerprint by multiple accounts may trigger the platform's security mechanisms, resulting in the account being restricted or closed.

- Multi-account demand differences: Each account may require different PayPal exchange rate settings and localizations.

- Low management efficiency:Maintaining multiple accounts takes a lot of time and effort, increasing operational costs.

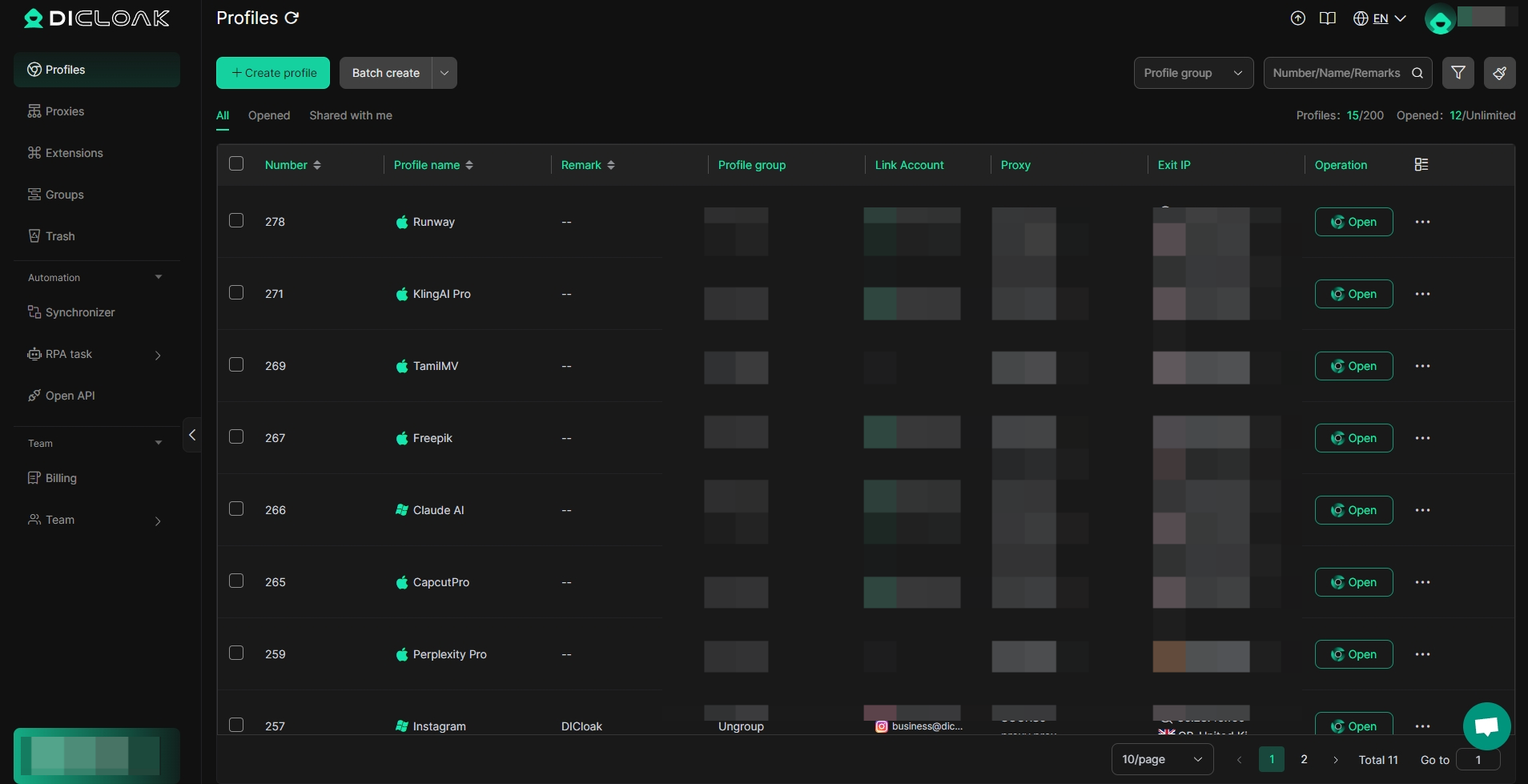

In order to deal with these problems,DICloak Fingerprint ViewerIt provides professional solutions for cross-border sellers. This multi-account management tool can build a separate browser environment for each account, helping sellers manage multiple accounts efficiently and securely, reducing the risk caused by account linkage.

The core features of DICloak Fingerprint Browser

- Stand-alone browser environment DICloak creates a completely independent operating environment for each PayPal account, including a unique browser fingerprint and local storage, ensuring that each account logs in from a different device and reduces the risk of being detected and linked.

- Customize your browser fingerprint It supports comprehensive browser fingerprint customization, such as User-Agent, screen resolution, Canvas fingerprint, fonts, and plug-ins, etc., to simulate the operating characteristics of real devices and effectively prevent association detection.

- Bulk action function DICloak supports the creation and import of multiple environments in bulk, whether it is a PayPal account or an e-commerce platform account, it can be easily and efficiently managed. This feature is especially suitable for cross-border e-commerce operators.

- Easy-to-use interface DICloak has an intuitive user interface that allows you to quickly configure the management environment for multiple accounts without technical background, reducing learning costs.

How do I manage multiple PayPal accounts with DICloak?

- In the DICloak interface, create a new browser environment and set up separate browser information for each PayPal account. Ensure that the fingerprint information is unique for each environment, simulating different device operations.

- Bulk import PayPal accounts and passwords to DICloak, and after completing the configuration, all accounts can be securely logged in from a separate environment.

- After the configuration is complete, you can use DICloak to easily switch between different accounts to achieve batch operations, while ensuring that each account is completely independent and avoiding associated risks.

Tip: If you need to modify the environment information (such as the environment name, group, account platform, or proxy information), you can complete the operation directly on the environment homepage to simplify and improve the process.

- furthermore DICloak Fingerprint ViewerIt is also equipped with powerful RPA automation functions, multi-environment opening functions, and cross-device login functions, which greatly improve the efficiency of account management. Among them, the RPA function allows sellers to set up automation scripts to perform highly repetitive tasks, such as logging into accounts, browsing content, etc., to truly automate operations. The multi-environment function allows sellers and teams to open the same environment for synchronization at the same time, saving time and effort to set up separately for each account. Cross-device login further optimizes operational flexibility, allowing users to easily manage multiple accounts anytime, anywhere, improving overall operational efficiency.

Whether it's understanding how PayPal sets exchange rates or learning the latest PayPal registration tutorials, mastering these two skills is crucial for cross-border e-commerce sellers. With DICloak Fingerprint Viewer, sellers can not only effectively manage multiple accounts, but also avoid associated risks, improve operational efficiency, and ultimately achieve steady business growth. And combinedDICloak Fingerprint ViewerWith the multi-account management function, you can easily build an independent operating environment to prevent account association, significantly improving management efficiency and account security. This will bring greater flexibility and reliability to the cross-border transaction process, allowing you to grow your business.

FAQs about PayPal

What is PayPal?

PayPal is a widely used online payment system that allows individuals and businesses to make secure electronic transfers. Users can send and receive payments, make payments for online purchases, and manage currency conversions through PayPal.

How do I sign up for a PayPal account?

Cross-border sellers need to knowPayPal registration latest tutorial, including providing a stable network environment, a valid address, mobile phone number, international email address and other basic information to ensure the smooth completion of the registration process.

Do I need to verify my real name for my US PayPal account?

Yes, PayPal may ask you for documents proving your identity, such as a passport or driver's license.

If I don't have a U.S. Social Security Number (SSN), can I still sign up for a PayPal account in the U.S.?

Yes, but functionality may be limited. Without an SSN, you may not be able to enjoy all of PayPal's services, such as withdrawals to a U.S. bank account.

Can I have both a personal account and a business account?

Yes, you can have both personal and business accounts, but they must be associated with different email addresses.

My PayPal account access is restricted, what should I do?

You need to log in to your PayPal account, follow the instructions provided to submit the required information such as ID card, passport, etc., and wait for the review to be lifted after the restriction is lifted.

What cards does PayPal support for cash withdrawals?

PayPal supports many types of cards for cash withdrawals, including Visa, MasterCard, Discover, and Amex cards, as well as bank accounts directly linked to PayPal. 、

How does PayPal calculate exchange rates?

PayPal's exchange rate calculations include the market benchmark rate and an additional currency conversion fee. Market benchmark rates are usually derived from the foreign exchange market, while surcharges are used to cover PayPal's service costs and potential risks.

Can I avoid using PayPal's exchange rate?

Yes, you can change the currency conversion option in PayPal's settings, choosing to pay using the exchange rate provided by your connected credit card bank.